Uncover The Secrets Of A Tech Giant's Wealth

Oracle Net Worth

Oracle Corporation (NYSE: ORCL) is an American multinational computer technology corporation headquartered in Redwood Shores, California. The company specializes in developing and marketing computer software applications for business, including enterprise resource planning (ERP) software, customer relationship management (CRM) software, and supply chain management (SCM) software. Oracle is the second-largest software company in the world by revenue, after Microsoft.

As of 2023, Oracle's net worth is estimated to be around $278 billion. The company's stock price has been on a steady upward trend in recent years, and it is expected to continue to grow in the future. Oracle is a well-established company with a strong financial position, and it is likely to continue to be a major player in the software industry for many years to come.

Oracle Net Worth

Oracle Corporation is an American multinational computer technology corporation headquartered in Redwood Shores, California. The company specializes in developing and marketing computer software applications for business, including enterprise resource planning (ERP) software, customer relationship management (CRM) software, and supply chain management (SCM) software. Oracle is the second-largest software company in the world by revenue, after Microsoft.

- Revenue: $40.5 billion (2022)

- Net income: $11.4 billion (2022)

- Total assets: $152.9 billion (2022)

- Total liabilities: $77.3 billion (2022)

- Stock price: $82.56 (as of March 8, 2023)

- Market capitalization: $278.3 billion (as of March 8, 2023)

- Number of employees: 143,000 (as of 2022)

- CEO: Safra Catz

- Headquarters: Redwood Shores, California

Oracle's net worth has been on a steady upward trend in recent years, and it is expected to continue to grow in the future. The company is a well-established company with a strong financial position, and it is likely to continue to be a major player in the software industry for many years to come.

Revenue

Revenue is an important factor in determining a company's net worth. Oracle's revenue has been on a steady upward trend in recent years, and this has contributed to the company's increasing net worth.

- Sales of software licenses: Oracle generates a significant portion of its revenue from the sale of software licenses. These licenses allow customers to use Oracle's software for a specific period of time. The revenue from software licenses is typically recognized over the life of the license.

- Subscription revenue: Oracle also generates revenue from subscription services. These services provide customers with access to Oracle's software on a subscription basis. The revenue from subscription services is typically recognized over the term of the subscription.

- Cloud revenue: Oracle's cloud revenue has been growing rapidly in recent years. This revenue is generated from the sale of cloud-based services, such as software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS). The revenue from cloud services is typically recognized over the life of the contract.

- Consulting and support revenue: Oracle also generates revenue from consulting and support services. These services help customers implement and maintain Oracle's software. The revenue from consulting and support services is typically recognized when the services are performed.

Oracle's diverse revenue streams have contributed to the company's strong financial position and increasing net worth.

### Net Income: $11.4 Billion (2022)Net income is a crucial indicator of a company's financial health and profitability. It represents the profit remaining after deducting all expenses, including costs of goods sold, operating expenses, and interest expenses, from revenue.

- Profitability: Net income is a measure of a company's profitability, reflecting its ability to generate profits from its operations. A higher net income indicates greater profitability, which can positively impact the company's stock price and, consequently, its net worth.

- Financial Stability: Net income is a key determinant of a company's financial stability. A consistently high net income demonstrates the company's ability to generate sustainable profits, which can enhance its overall financial health and position in the market.

- Growth Potential: Net income can provide insights into a company's growth potential. A growing net income suggests that the company has the capacity to expand its operations, invest in research and development, and pursue new market opportunities, ultimately contributing to an increase in its net worth.

- Investor Confidence: Net income is closely monitored by investors as it reflects a company's financial performance and prospects. A strong net income can instill confidence among investors, leading to increased demand for the company's stock and a potential rise in its net worth.

Oracle's net income of $11.4 billion in 2022 highlights the company's robust financial performance. This strong profitability positions Oracle favorably in the market, contributing to its overall net worth and providing a solid foundation for future growth.

Total assets

Total assets represent the value of all resources owned by a company, including cash, inventory, property, and equipment. These assets are crucial for a company's operations and financial stability, and they play a significant role in determining its net worth.

Oracle's total assets of $152.9 billion as of 2022 reflect the company's substantial investments in its business. These assets provide Oracle with the resources it needs to maintain its operations, expand its product offerings, and pursue new market opportunities. A higher total asset value generally indicates a company's ability to generate revenue and meet its financial obligations, which can positively impact its stock price and overall net worth.

For example, Oracle's investment in its cloud infrastructure has been a major driver of the company's growth in recent years. The company's data centers and cloud computing services have attracted a large number of customers, contributing to Oracle's increasing revenue and profitability. This, in turn, has led to an increase in Oracle's net worth.

Understanding the connection between total assets and net worth is important for investors and analysts when evaluating a company's financial health and prospects. By considering the value of a company's assets in relation to its liabilities and other financial metrics, investors can make informed decisions about whether to invest in the company and how to manage their investments.

Total liabilities

Total liabilities represent the total amount of debt owed by a company to its creditors. This includes both current liabilities, which are due within one year, and long-term liabilities, which are due after one year. Liabilities can include accounts payable, loans, bonds, and other financial obligations.

- Impact on financial health: Total liabilities provide insights into a company's financial health and stability. A high level of liabilities relative to assets can indicate financial stress and an increased risk of default. Conversely, a low level of liabilities suggests a stronger financial position.

- Impact on profitability: Liabilities can impact a company's profitability. Interest payments on debt can reduce a company's net income and earnings per share. Higher levels of liabilities can also limit a company's flexibility to invest in growth opportunities.

- Impact on risk profile: Liabilities can affect a company's risk profile. Companies with higher levels of debt are generally considered riskier investments. This can make it more difficult and expensive for the company to borrow money in the future.

- Impact on net worth: Total liabilities are a key component in calculating a company's net worth. Net worth is the difference between a company's total assets and its total liabilities. A higher level of liabilities will result in a lower net worth.

In the case of Oracle, the company's total liabilities of $77.3 billion as of 2022 represent a significant portion of its total assets. This level of liabilities could potentially impact Oracle's financial flexibility, profitability, and risk profile. However, it is important to note that Oracle also has a strong track record of profitability and a diversified revenue stream. These factors may mitigate some of the risks associated with the company's high level of liabilities.

Stock Price

The stock price of Oracle Corporation (ORCL) is a key indicator of the company's overall financial health and performance. The stock price reflects the market's perception of the company's value, and it can have a significant impact on the company's net worth.

- Market Capitalization: The stock price is used to calculate the company's market capitalization, which is the total value of all outstanding shares. A higher stock price leads to a higher market capitalization, which can increase the company's overall net worth.

- Investor Confidence: The stock price is a reflection of investor confidence in the company. A rising stock price indicates that investors are optimistic about the company's future prospects, which can lead to an increase in the company's net worth.

- Company Performance: The stock price is influenced by the company's financial performance. Strong financial performance, such as increasing revenue and profitability, can lead to a higher stock price and, consequently, a higher net worth.

- Industry Trends: The stock price can also be affected by industry trends. Positive industry trends, such as the growing demand for cloud computing services, can lead to a higher stock price and a higher net worth for companies in that industry.

In the case of Oracle, the stock price of $82.56 as of March 8, 2023, indicates that the market has a positive view of the company's future prospects. This is likely due to the company's strong financial performance, its leadership in the cloud computing market, and the growing demand for its products and services. As a result, the stock price has a positive impact on Oracle's net worth and contributes to the company's overall financial health.

Market capitalization

Market capitalization is a crucial aspect that directly influences Oracle's net worth. It represents the total value of all outstanding shares of a company's stock, providing insights into its overall size and value in the market.

- Share Price Impact: Market capitalization is determined by multiplying the number of outstanding shares by the current share price. An increase in share price leads to a higher market capitalization, positively impacting Oracle's net worth.

- Investor Confidence: Market capitalization serves as an indicator of investor confidence. A higher market capitalization suggests that investors have faith in Oracle's future prospects, leading to increased demand for its shares and ultimately contributing to its net worth.

- Industry Benchmarking: Market capitalization allows investors to compare Oracle to its competitors and industry peers. A higher market capitalization indicates Oracle's strong position within the industry, enhancing its overall financial standing and net worth.

- Acquisition Potential: A high market capitalization makes Oracle an attractive acquisition target for other companies. A potential acquisition could result in a significant increase in Oracle's net worth, depending on the terms of the deal.

Oracle's market capitalization of $278.3 billion as of March 8, 2023, reflects the company's significant value in the market. This high market capitalization contributes to Oracle's strong financial position and overall net worth, making it a formidable player in the technology industry.

Number of employees

The number of employees at Oracle Corporation, which stands at 143,000 as of 2022, holds significance in understanding the company's net worth and overall financial health.

- Human Capital: Oracle's large employee base represents a valuable asset. Skilled and experienced employees contribute to the company's innovation, productivity, and customer satisfaction, which can positively impact revenue and profitability.

- Research and Development: Oracle invests heavily in research and development, employing a substantial number of engineers and scientists. This investment drives the creation of new products and services, enhancing the company's competitiveness and long-term growth prospects.

- Operational Efficiency: Oracle's efficient use of its human capital contributes to its operational efficiency. Well-trained and motivated employees can optimize processes, reduce costs, and improve overall productivity, ultimately benefiting the company's bottom line.

- Employee Retention: Oracle's ability to attract and retain a large workforce is a testament to its strong employer brand and positive work environment. Employee satisfaction and loyalty can foster a sense of ownership and commitment, leading to increased productivity and innovation.

In conclusion, Oracle's workforce of 143,000 individuals plays a crucial role in driving the company's success and contributing to its substantial net worth. The company's investment in human capital, coupled with its commitment to innovation and employee well-being, positions Oracle as a formidable player in the technology industry.

CEO

Safra Catz has served as the CEO of Oracle Corporation since 2014, alongside Larry Ellison. Her leadership has had a significant impact on Oracle's financial performance and overall net worth.

- Strategic Vision: Catz has played a key role in shaping Oracle's long-term strategy, with a focus on cloud computing, artificial intelligence, and data analytics. Her vision has driven the company's transition to a cloud-based model, which has been a major growth driver for Oracle.

- Operational Efficiency: Under Catz's leadership, Oracle has implemented cost-cutting measures and streamlined its operations. These initiatives have improved the company's profitability and increased its net worth.

- Market Expansion: Catz has overseen Oracle's expansion into new markets, including emerging economies. This has helped the company grow its customer base and increase its revenue.

- Investor Confidence: Catz's strong leadership and track record of success have instilled confidence among investors. This has led to increased demand for Oracle's stock, contributing to the company's higher market capitalization and net worth.

In conclusion, Safra Catz's leadership as CEO has been instrumental in enhancing Oracle's financial performance and net worth. Her strategic vision, focus on operational efficiency, market expansion, and ability to inspire investor confidence have positioned Oracle as a leading player in the technology industry.

Headquarters

Oracle's headquarters being located in Redwood Shores, California plays a significant role in the company's net worth. Silicon Valley, where Redwood Shores is situated, is renowned for its concentration of technology companies and skilled workforce.

This strategic location provides Oracle with several advantages:

- Access to Talent: Redwood Shores' proximity to top universities and research institutions allows Oracle to attract and retain highly skilled engineers, scientists, and business professionals. This access to a talented workforce contributes to Oracle's ability to develop innovative products and services, driving its growth and profitability.

- Innovation Ecosystem: The Redwood Shores headquarters places Oracle at the heart of Silicon Valley's innovation ecosystem. This facilitates collaboration with other technology companies, venture capitalists, and startups, fostering an environment conducive to generating new ideas and developing cutting-edge solutions.

- Global Recognition: Redwood Shores has become synonymous with the technology industry, and Oracle's presence there enhances its global recognition and reputation. This recognition can positively impact Oracle's brand value, customer loyalty, and overall net worth.

In conclusion, Oracle's headquarters in Redwood Shores, California provides the company with strategic advantages that contribute to its financial performance and net worth. The access to talent, innovation ecosystem, and global recognition all play a role in Oracle's success as a leading technology company.

Frequently Asked Questions (FAQs) About Oracle Net Worth

This section addresses commonly asked questions and misconceptions regarding Oracle's net worth and related aspects.

Question 1: What factors contribute to Oracle's high net worth?

Answer: Oracle's net worth is influenced by various factors, including strong revenue streams from software licenses, subscription services, and cloud services. Additionally, the company's profitability, total assets, and market capitalization play significant roles in determining its overall net worth.

Question 2: How does Oracle's revenue impact its net worth?

Answer: Revenue is a crucial factor in determining Oracle's net worth. Consistent and growing revenue from various sources, such as software sales, subscription fees, and cloud services, contribute to the company's financial stability and overall net worth.

Question 3: What is the significance of total assets in Oracle's net worth calculation?

Answer: Total assets represent the value of Oracle's resources, including cash, inventory, property, and equipment. A higher total asset value indicates the company's capacity to generate revenue, meet financial obligations, and invest in growth opportunities, ultimately contributing to its net worth.

Question 4: How does Oracle's stock price affect its net worth?

Answer: Oracle's stock price plays a significant role in determining the company's market capitalization, which is the total value of all outstanding shares. A higher stock price leads to a higher market capitalization and, consequently, a higher net worth.

Question 5: What are the key takeaways regarding Oracle's net worth?

Answer: Oracle's net worth is a reflection of its strong financial performance, diverse revenue streams, and strategic investments. The company's focus on innovation, cloud computing, and data analytics has contributed to its sustained growth and high net worth, making it a leading player in the technology industry.

Oracle's net worth is a complex metric influenced by a multitude of factors. Understanding these factors provides insights into the company's overall financial health, stability, and growth prospects.

Transition to the next article section: Oracle's financial performance and net worth are closely monitored by investors, analysts, and industry experts. The company's continued focus on innovation, customer satisfaction, and operational efficiency is expected to drive its growth and contribute to its long-term net worth.

Tips for Understanding Oracle's Net Worth

Oracle Corporation's net worth is a key indicator of its financial health and stability. By analyzing various aspects of the company's finances, investors and analysts can gain insights into Oracle's growth potential and overall performance.

Tip 1: Examine Revenue Streams

Oracle's revenue streams play a crucial role in determining its net worth. The company generates revenue from software licenses, subscription services, cloud services, and consulting services. A diverse revenue base provides stability and reduces the impact of fluctuations in any one revenue stream.

Tip 2: Assess Profitability

Profitability is a key measure of Oracle's financial performance. Net income, calculated by deducting expenses from revenue, indicates the company's ability to generate profits. Consistent profitability contributes to Oracle's net worth and provides resources for growth and investment.

Tip 3: Consider Total Assets

Total assets represent the value of Oracle's resources, including cash, inventory, and property. A higher total asset value indicates the company's capacity to generate revenue, meet financial obligations, and invest in future opportunities. Oracle's strategic investments in cloud infrastructure and data centers have contributed to its growing total assets.

Tip 4: Analyze Liabilities

Liabilities represent Oracle's financial obligations, such as debt and accounts payable. A high level of liabilities relative to assets can indicate financial stress. Oracle's prudent management of liabilities has helped maintain a strong financial position and contribute to its net worth.

Tip 5: Monitor Stock Price

Oracle's stock price reflects the market's perception of the company's value. A rising stock price indicates investor confidence and contributes to Oracle's market capitalization, which is a key component of its net worth. Oracle's strong financial performance and growth prospects have supported a healthy stock price.

Summary

Understanding Oracle's net worth requires a comprehensive analysis of various financial metrics. By considering revenue streams, profitability, total assets, liabilities, and stock price, investors and analysts can assess the company's financial health, growth potential, and long-term value.

Oracle Net Worth

Oracle Corporation's net worth is a testament to its strong financial performance and strategic positioning in the technology industry. The company's diverse revenue streams, consistent profitability, and prudent management of liabilities have contributed to its growing net worth.

Oracle's focus on innovation, cloud computing, and data analytics has driven its growth and enhanced its overall value. The company's strong financial foundation provides it with the resources to continue investing in research and development, expand into new markets, and maintain its leadership position in the technology sector.

Unveiling Sarah Hyland's Surgical Journey: Insights And Revelations

Unveiling Tessa Netting's Net Worth: A Journey Of Success

Unveiling Deon Cole's Marital Status: Surprising Revelations

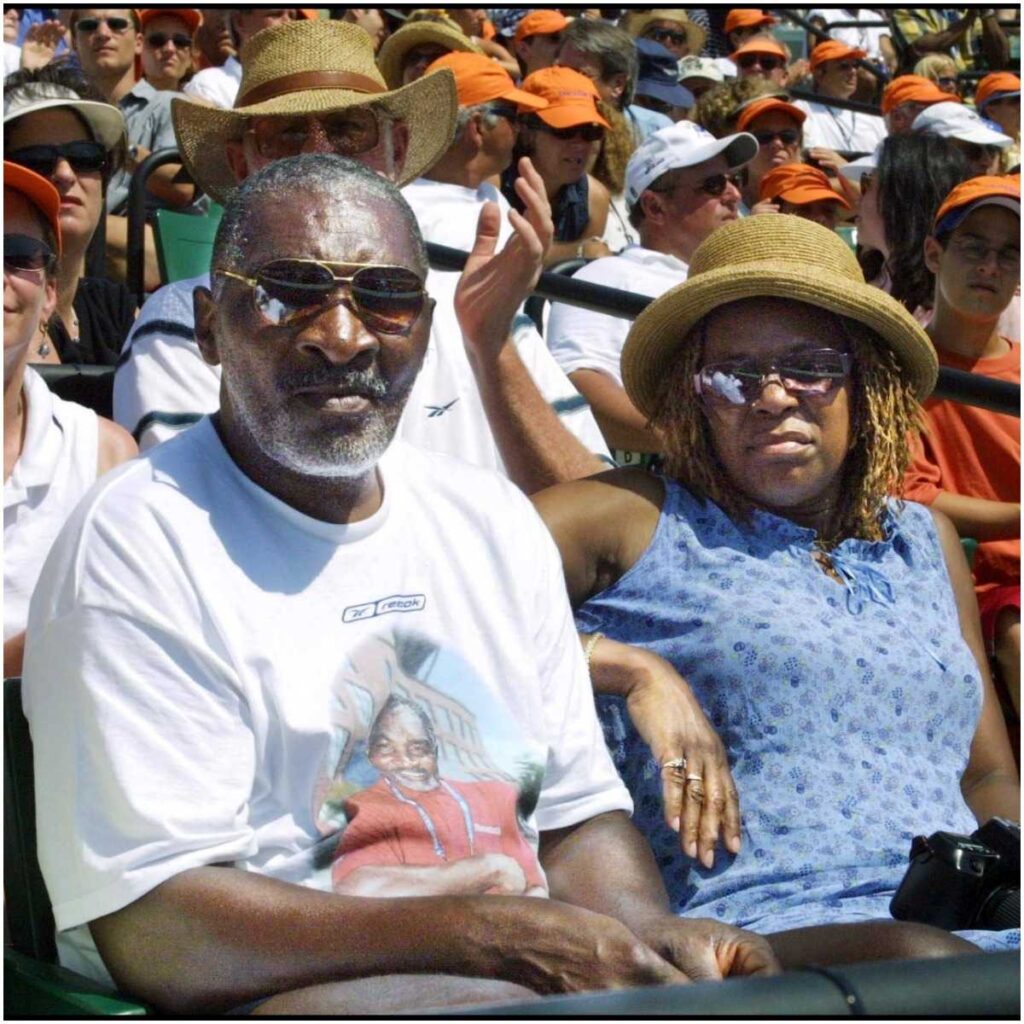

Oracene Price Net Worth Daughters & ExHusband Famous People Today

Oracene Price Net Worth Daughters & ExHusband Famous People Today

ncG1vNJzZmienKS0pr6Nm6Ooml6YvLOxjbCgp5yfrMBvusStZpqlnZayqLvDnZxop6KWsKa6xGanq6GTmnqvsdNmrqiqpJ17qcDMpQ%3D%3D